Contemplating the leap from renting to homeownership? Here are some key factors to consider while making this decision:

Escalating Rent.

With national rental prices soaring, a significant increase in your monthly rent can trigger the realization that homeownership might be a more prudent financial move. As your rent rises, building equity through a mortgage becomes an appealing alternative.

Solid Credit Score.

A healthier credit score opens doors to better mortgage terms and interest rates. Take a moment to assess your credit health. Are there areas you can improve? Consider obtaining a free credit report to identify and address any issues.

Manageable Debt.

Lenders scrutinize your debt-to-income ratio, and maintaining a reasonable ratio can enhance your chances of qualifying for a mortgage. It also allows more flexibility in your budget for emergency funds and unexpected home expenses. The 28/36 dictates you spend no more than 28% of your gross monthly income on housing costs and no more than 36% on all of your debt combined, including those housing costs.

Affordable Down Payment.

First-time homebuyers often face the challenge of accumulating a down payment. Understanding the requirements for different loan types and exploring available grants or programs can help ease this hurdle.

Budget for Maintenance.

Unlike renting, homeownership brings additional costs for maintenance, repairs & insurance. Some specialists recommend setting aside 1% to 2% of your homes purchase price each year for routine maintenance projects such as roofing repairs, sewer, or new appliances.

Major Life Change.

Significant life events, such as marriage, growing family, or a new job, often prompt individuals to consider homeownership. While these events can be catalysts, it’s essential to avoid major changes during the home-buying process, as they can complicate the process.

Stable Lifestyle.

Anticipating stability in your location and job is crucial. Upfront costs in homeownership take time to recover, making it less suitable for those expecting relocation.

Clear Preferences.

Knowing your desired neighborhood, type of home, and essential features before beginning your home search streamlines the process and ensures a more informed decision.

If this resonate with you, it might be time to explore homeownership. Begin by shopping around for lenders and getting preapproved for a mortgage. Ensure that homeownership aligns with your broader financial goals, allowing you to achieve a range of objectives while enjoying the benefits of owning a home. Engage with an experienced local real estate agent to guide you through the house-hunting phase & help you find your perfect home.

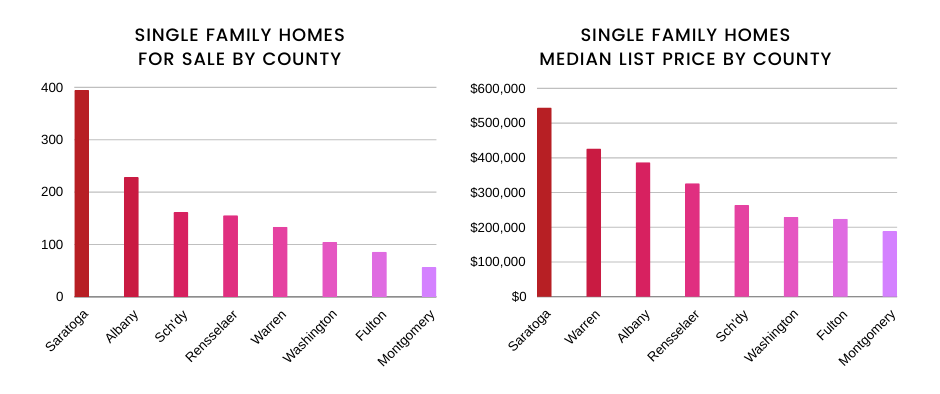

Let’s talk market updates.

Despite a modest 4.9% decrease in prices from November to December, the Capital Region maintains relatively high median sales prices, reaching $290,000.

Buyers found some negotiation leverage as the Months Supply of Inventory expanded to approximately 2 months in November. However, December reveals a shift, signaling increased market activity, with the supply decreasing to 1.9 months. These fluctuations suggest a dynamic environment, urging both buyers and sellers to stay attuned to evolving trends.

Ready to be a home owner? Let’s find your perfect home today!