If you’re considering buying or selling a home, you’ve likely heard that the Federal Reserve’s actions impact the market. While it doesn’t set mortgage rates directly, changes to the Federal Funds Rate—the rate at which banks lend to each other—can influence mortgage rates over time. The Fed meets again this week to decide the next step with the Federal Funds Rate. Here’s how this affects the housing market and what you can do to prepare.

The Fed’s actions to raise or lower the Federal Funds Rate are based on three main indicators:

1. Inflation Trends

2. Job Growth

3. Unemployment levels

These economic indicators provide insight into the health of the economy, and the Fed’s response to each one affects the housing market’s overall environment, including mortgage rates.

Inflation Trends

As prices for everyday items fluctuate, the Fed aims to bring inflation close to its target of 2% to keep the economy stable. Although inflation has been easing, it’s still above the desired level, so the Fed is monitoring closely. If inflation continues to decrease, the Fed may lower the Federal Funds Rate gradually, which could make borrowing more affordable for buyers in the coming months.

Job Growth

Job creation is another factor the Fed examines. When the economy slows down and fewer jobs are created, it signals a cooling period, which is favorable for inflation control. Currently, job growth has slowed, suggesting the Fed may ease rates further, potentially opening the door for lower mortgage rates over time.

Unemployment Levels

A low unemployment rate generally indicates that most people who want jobs can find them. Right now, unemployment remains low at about 4.1%. While this is a positive economic sign, a low unemployment rate can contribute to inflation, because more people working means more spending—and that makes prices go up. The Fed carefully watches this metric to maintain a balance between steady employment and manageable inflation.

What This Means for Buyers and Sellers

If the Fed lowers the Federal Funds Rate, mortgage rates might trend downward, though not necessarily overnight. Rate adjustments can take time to trickle down and may not impact mortgage rates as quickly as we might hope.

For Buyers

Lower mortgage rates generally mean lower monthly payments. This can expand your purchasing power, allowing you to afford a higher-priced home or save on monthly costs. Rather than waiting for a rate dip, consider working on financial preparedness and watch for favorable market conditions that include increased housing inventory, and stabilizing home prices. Seasonal trends, like shopping in the winter when competition is lower, can also create more negotiating room. By improving your financial readiness—like boosting your credit and saving for a down payment—you can be ready to act when these conditions align, maximizing your purchasing power.

For Sellers

Easing rates could drive up buyer interest, which often leads to a more active market. Preparing your home to stand out—through repairs or updates that could boost appeal and value, or strategic pricing—can help you attract motivated buyers who are taking advantage of improved borrowing conditions.

To navigate these potential shifts, here’s what you can do to prepare:

Track Rate Trends: Stay up-to-date on interest rate movements. Lenders and real estate agents can provide guidance on how interest rates and other market shifts may affect your timing and options.

Get Financially Ready: If you’re buying, focus on getting pre-approved for a mortgage to confirm your budget. Pre-approval will not only give you a clear idea of your buying power but also position you as a more competitive buyer.

Work with Trusted Real Estate and Financial Professionals: Since mortgage rates and market conditions can be unpredictable, consulting with a knowledgeable real estate agent and lender is essential. They can help you navigate the buying or selling process and develop strategies based on the latest economic and market data.

With a proactive approach to financial planning, timing, and market knowledge, you’ll be better prepared to make informed decisions in this market.

Market Update

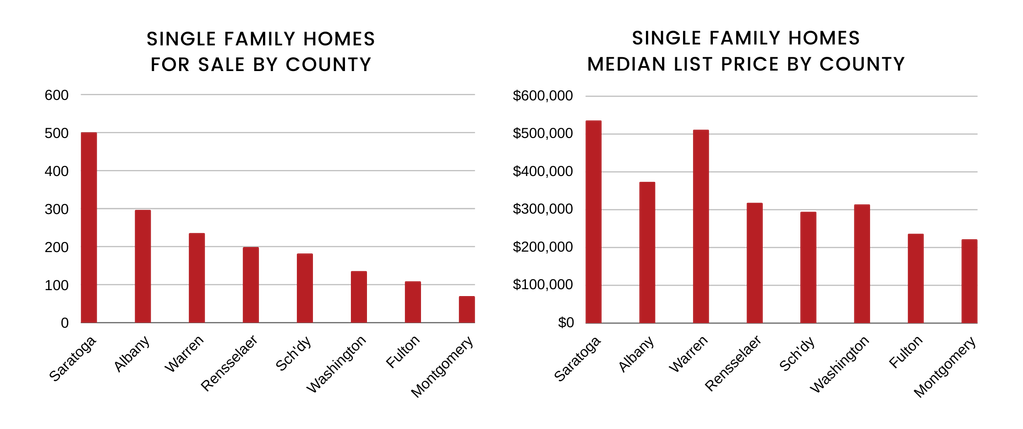

The Capital Region’s real estate market remains competitive, with inventory holding steady at around two months supply—well below the 5-6 months needed for a balanced market. October’s average list price in the Capital District was $462K, down slightly from September’s $467K. Homes spent an average of 53 days on the market, with a median of just 24 days, highlighting a brisk pace for serious buyers despite some signs of stabilization. The average Sold-to-Original List Price Ratio sits at 98.9%, indicating that while some sellers are making price adjustments to accommodate longer market times, initial list prices are generally close to target, reflecting only minor overpricing in a still-demanding market. Source: Global MLS 11.06.2024

Featured Listing

[idx-listing mlsnumber=”HowtheFederalreserveShapestheHousingMarket:WhatBuyersandSellersNeedtoKnow” showschools=”true” showextradetails=”true” showfeatures=”true” showlocation=”true”]